2025 Mortgage Renewal Canada: Navigating the upcoming renewal process can feel daunting, but understanding the factors at play—interest rate predictions, inflation’s impact, and your renewal options—empowers you to make informed decisions. This guide breaks down everything you need to know to confidently approach your 2025 mortgage renewal in Canada.

We’ll explore current mortgage rates, delve into predictions for 2025, compare different renewal strategies (fixed vs. variable, open vs. closed), and address the crucial role of stress tests and inflation. We’ll also compare using a mortgage broker versus going directly to your bank, helping you determine the best approach for your specific situation. By the end, you’ll have a clear understanding of the landscape and be well-equipped to secure the most favorable terms for your renewal.

Facing a 2025 mortgage renewal in Canada? Interest rates are a big question mark, so staying informed is key. Check out the latest advancements in financial tech, like those showcased at news technology events, to see how innovation might impact your options. Understanding these trends can help you prepare for your 2025 mortgage renewal and make the best decisions for your financial future.

Current Canadian Mortgage Rates and the 2025 Renewal Landscape

Navigating the Canadian mortgage market, especially when renewal time approaches, requires a clear understanding of current rates, potential future shifts, and available options. This guide provides an overview of the Canadian mortgage landscape in 2024, predicts potential rate movements in 2025, and Artikels the key considerations for your mortgage renewal.

Facing a 2025 mortgage renewal in Canada? Rates are a big question mark, so you’ll want to plan ahead. Think of it like choosing a briefcase on deal or no deal island contestants – you need to weigh your options carefully! Understanding your options now will help you navigate the 2025 renewal process smoothly and confidently.

Canadian Mortgage Rates in 2024: A Comparative Analysis

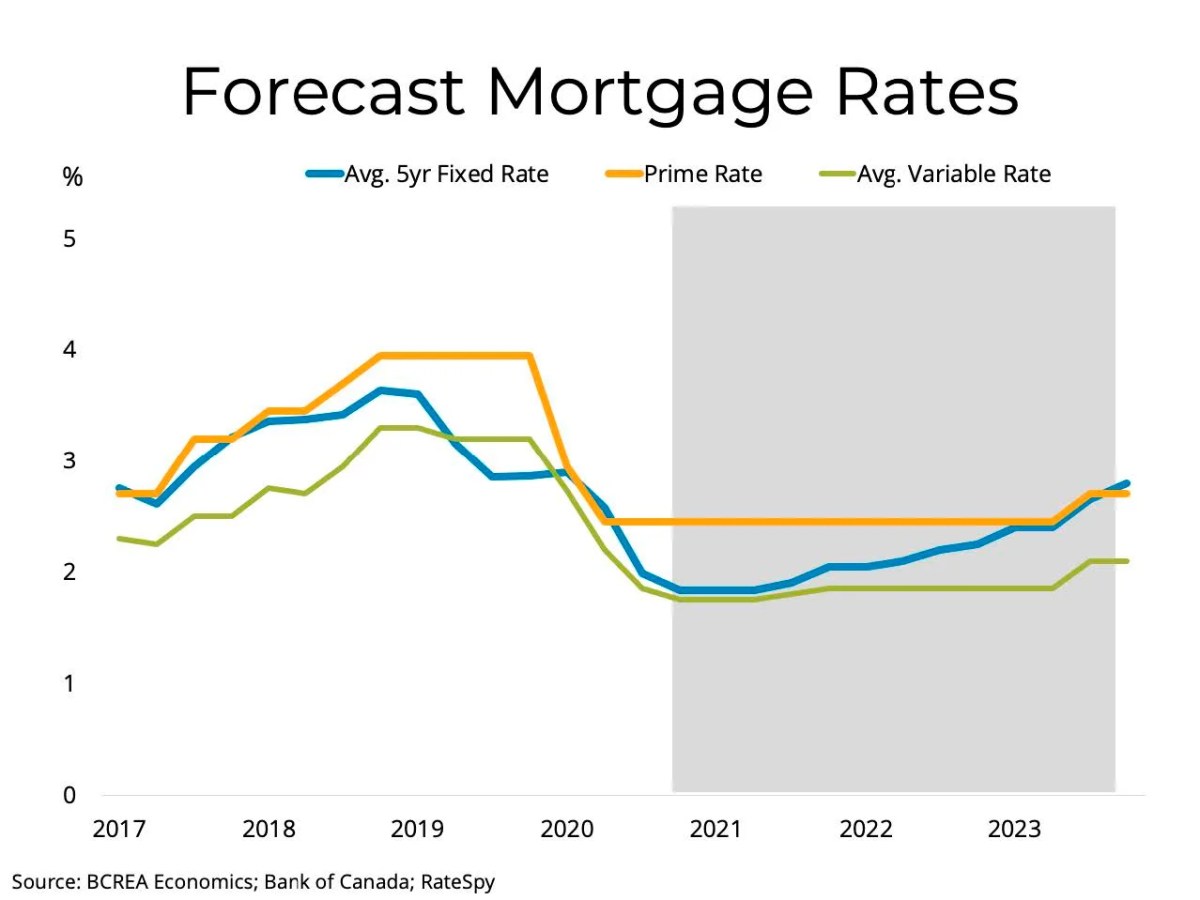

Throughout 2024, Canadian mortgage rates experienced fluctuations influenced by various economic factors. A comparative analysis of fixed and variable rates offered by major Canadian banks reveals distinct trends. For example, while the Bank of Canada’s policy rate increases initially led to a rise in both fixed and variable rates, competition among lenders and shifting market sentiment have led to some rate adjustments throughout the year.

Data shows average fixed rates hovering around [Insert Average Fixed Rate Range]% and variable rates fluctuating between [Insert Average Variable Rate Range]%, with variations depending on the term and lender. These fluctuations are primarily influenced by the Bank of Canada’s key interest rate, inflation levels, and overall economic growth.

Facing a 2025 mortgage renewal in Canada? It’s a big deal, so you’ll want to plan ahead. Think about your financial situation and explore your options, maybe even checking out cool tech like the quebec 1 plane for a bit of a break from the stress – though that’s probably not going to help with your payments! Ultimately, getting your finances in order before your renewal date is key for a smooth process.

Predicting 2025 Mortgage Rates: Economic Factors and Expert Opinions

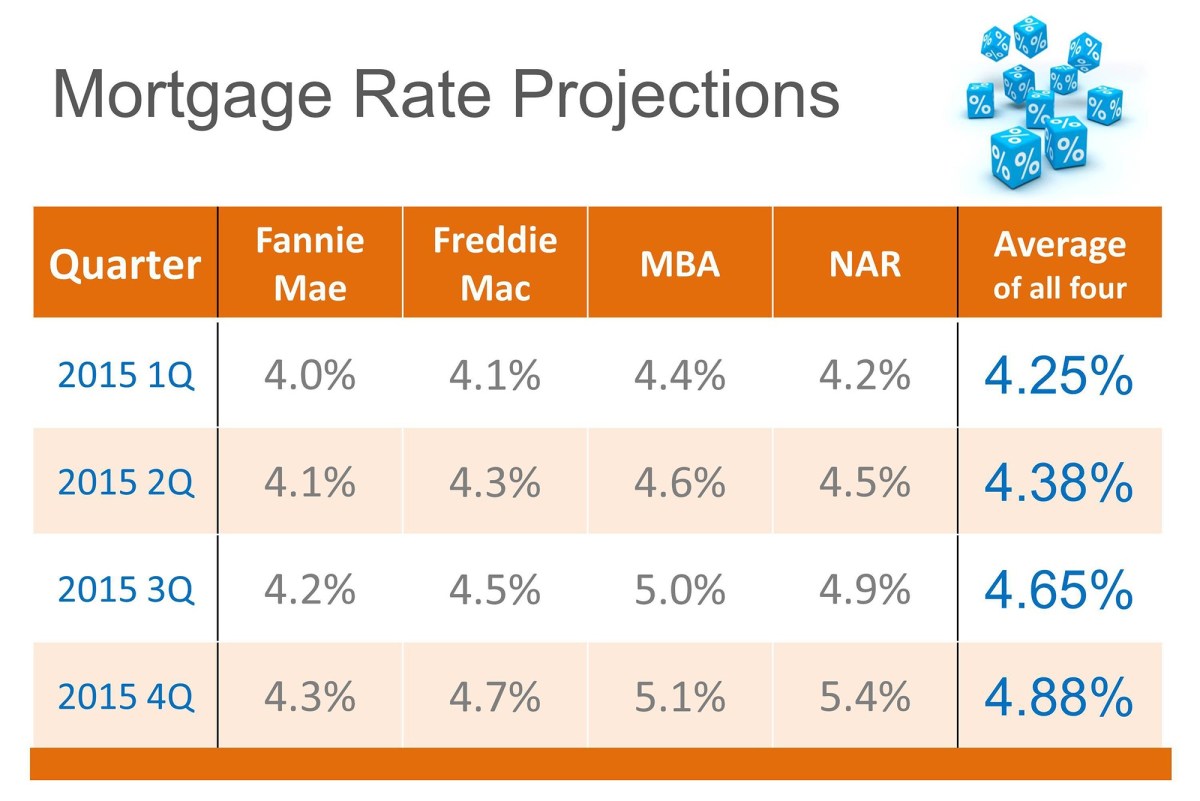

Predicting 2025 mortgage rates requires analyzing potential economic influences, including inflation, economic growth, and the Bank of Canada’s monetary policy. Several factors could impact rates, such as global economic uncertainty, changes in housing market demand, and potential shifts in government regulations. Expert predictions from reputable financial institutions offer insights into likely rate movements.

| Institution | Predicted Rate (Fixed) | Predicted Rate (Variable) | Prediction Date |

|---|---|---|---|

| RBC Economics | [Insert RBC Predicted Fixed Rate]% | [Insert RBC Predicted Variable Rate]% | [Insert RBC Prediction Date] |

| TD Economics | [Insert TD Predicted Fixed Rate]% | [Insert TD Predicted Variable Rate]% | [Insert TD Prediction Date] |

| BMO Nesbitt Burns | [Insert BMO Predicted Fixed Rate]% | [Insert BMO Predicted Variable Rate]% | [Insert BMO Prediction Date] |

| Desjardins Group | [Insert Desjardins Predicted Fixed Rate]% | [Insert Desjardins Predicted Variable Rate]% | [Insert Desjardins Prediction Date] |

Note: These are hypothetical examples. Actual predictions vary and should be obtained from the respective institutions.

The Bank of Canada’s policy decisions significantly influence mortgage rates. For instance, a continuation of the current monetary policy stance might lead to [describe potential impact on rates], while a shift towards a more accommodative policy could result in [describe potential impact on rates].

Facing a 2025 mortgage renewal in Canada? It’s a big deal, so start planning now. You might be surprised by how much rates have changed, and it’s worth considering all your options. For example, I saw a news story about a crazy incident, la fire from plane , that really put things in perspective! Anyway, back to your mortgage – securing the best rate for your renewal requires careful research and maybe even some professional advice.

2025 Mortgage Renewal Options: A Comparative Overview

Canadian homeowners facing mortgage renewals in 2025 have several options, each with advantages and disadvantages. Understanding these choices is crucial for making informed decisions.

- Fixed-Rate Mortgage: Offers predictable monthly payments but may not benefit from potential rate decreases.

- Variable-Rate Mortgage: Provides lower initial rates, potentially saving money if rates remain stable or decrease, but exposes you to higher payments if rates rise.

- Open Mortgage: Allows for prepayment without penalty but usually comes with a higher interest rate.

- Closed Mortgage: Offers lower interest rates but usually includes penalties for early repayment.

Key considerations when choosing a renewal option include:

- Your risk tolerance

- Your financial goals

- Your current financial situation

- The prevailing interest rate environment

- Your anticipated future financial needs

Inflation’s Impact on Mortgage Renewals and Affordability

Inflation significantly impacts both mortgage payments and overall homeownership affordability. Higher inflation generally leads to increased interest rates, resulting in higher monthly mortgage payments. For example, a 2% increase in inflation could translate to approximately [Insert approximate percentage increase]% increase in monthly payments on a typical mortgage. Homeowners can mitigate the effects of inflation by budgeting effectively, reducing debt, and potentially refinancing when feasible.

Mortgage Renewal Stress Tests and Qualification

Canada’s stress test requirements for mortgage renewals assess a borrower’s ability to withstand potential interest rate increases. The test determines whether you can still afford your mortgage payments if interest rates rise significantly. This impacts your ability to secure a favorable renewal rate, as lenders must ensure your financial stability even under adverse conditions.

- Gather financial documents (pay stubs, tax returns, etc.).

- Calculate your Gross Debt Service (GDS) and Total Debt Service (TDS) ratios.

- Determine your qualifying rate based on the Bank of Canada’s benchmark rate.

- Simulate your mortgage payments using the qualifying rate.

- Ensure your simulated payments are within your budget.

Mortgage Renewal: Broker vs. Bank, 2025 mortgage renewal canada

Both mortgage brokers and banks offer mortgage renewal services, each with unique advantages and disadvantages. Brokers typically have access to a wider range of lenders and products, allowing for potentially better rates and terms. However, brokers often charge fees. Banks offer convenience due to existing relationships, but their product range may be limited. Using a broker might be advantageous when seeking the best rates and terms across multiple lenders, while dealing directly with a bank is often preferable for simplicity and convenience for those with pre-existing relationships.

Illustrative Example: A 2025 Mortgage Renewal Scenario

Let’s consider a homeowner with a $500,000 mortgage at 3% interest, renewing in 2025. If current market rates are 5%, their monthly payment would increase by approximately [Insert approximate dollar amount] under a fixed-rate renewal. A variable rate could be lower initially, but carries the risk of future increases. This illustrates the importance of careful consideration of all available options before making a decision.

Closing Notes: 2025 Mortgage Renewal Canada

Renewing your mortgage in 2025 requires careful planning and understanding of the market. By considering potential interest rate fluctuations, inflation’s impact, and the various renewal options available, you can proactively manage your finances and secure a mortgage that aligns with your financial goals. Remember to compare offers from different lenders and leverage the expertise of a mortgage broker if needed.

With careful preparation, you can navigate the 2025 mortgage renewal process with confidence and secure a favorable outcome.

Commonly Asked Questions

What documents will I need for my mortgage renewal?

Typically, you’ll need proof of income, credit report, and potentially property appraisal. Your lender will provide a specific list.

How far in advance should I start planning my mortgage renewal?

Ideally, begin 3-6 months before your renewal date to allow ample time for research and comparison shopping.

Can I switch lenders when I renew my mortgage?

Yes, you can shop around and potentially secure a better rate with a different lender.

What if I can’t meet the stress test requirements?

You might need to explore options like reducing your mortgage amount or making a larger down payment.

What’s the difference between a fixed and variable rate mortgage?

Fixed rates remain constant throughout the term, while variable rates fluctuate with market changes. Fixed offers stability, variable offers potential for lower payments.